The importance of diversity in recruitment and leadership is a major focus for our clients at Lancor. This year alone, we have seen a record level of diverse hires. Leadership that features diversity in age, background, gender, experience and culture, has finally gained traction for the long haul in an asset class known to be laser focused on data-based decisions. Interestingly, diversity on Private Equity Boards and C-Suites, is not only a socially-responsible decision, but also based on proof that it drives higher returns.

A recent McKinsey study found that the top 25% of companies that feature workforce diversity are 33% more likely to outperform competition that has more homogenous leadership. According to Harvard Business Review, companies with above-average total diversity (measured as an average of nationality, industry, career path, gender, education and age) had both a 19% increase in innovation revenue and a 9% points higher EBIT margins, on average.

The reason for the increase in profit is fascinating and backed by research. A more varied set of opinions and perspectives bring about better decision-making and problem solving, than groups that are more similar. This is even the case, when leaders are from the top schools and /or top corporate training programs. Filling boards or top level management teams with one hiring strategy (only hiring from the top business schools, for example) won’t yield the top decile results companies strive for.

For those who love a deep dive into this modeling and complexity of social sciences, please follow this link to a podcast from the Santa Fe Institute. It includes dozens of examples and studies that consistently prove the direct link between diversity and top returns. According to Scott Page, the key presenter in this podcast and author of The Diversity Bonus: How Great Teams Pay Off in the Knowledge Economy, different viewpoints actually can trump ability, when making predictions in business. In the studies he conducted, the more diverse group always outperformed the alpha group (as defined by pooling the top, pure performers) by a substantial margin.

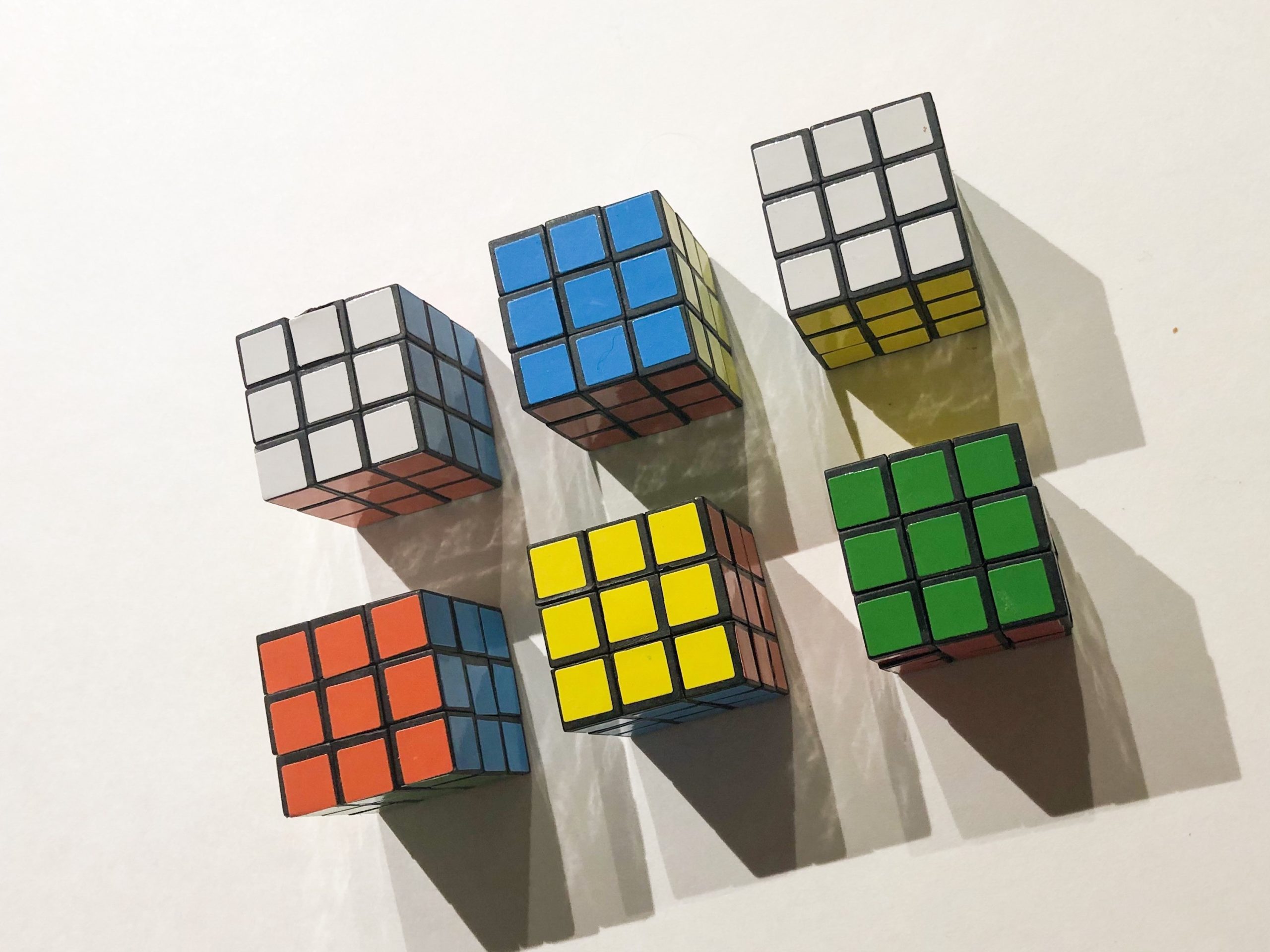

I find this concept of the need for a diverse skill set can be seen easily through the famous puzzle / toy, The Rubik’s Cube. It was originally advertised as having “over 3,000,000,000 (three billion) combinations but only one solution” but there are actually as many as 43 quintillion according to Wikipedia. In any event, it is basically impossible to solve without a roadmap. To extrapolate to the C-Suite or a Board, if the ability to solve the Rubik’s Cube was an important factor in creating top decile value in a company, having a more diverse team to include someone with non-traditional skill set of knowing how to solve this puzzle would be the key to unlocking value that others do not immediately see. Unusual asset specific knowledge or a related differentiated vision is the entire premise of the Lancor Advisory Business (“LAB”) and why diversity matters as an essential component of top returns. Collectively, management needs to solve the obvious problems well, but also need to see around corners and solve problems that they did not expect to have to solve with the most powerful team possible.

The correlation of diversity to top returns is highlighted by a recent study by HEC, that showed that “buyout teams with at least one woman outperformed all-male teams by an average of 12% of IRR (internal rate of return) and a remarkable 52 cents per dollar invested.” However, women still occupy only 9.4% of senior jobs in private equity and according to Forbes, Asian Americans account for only 5% of senior executive positions, Black Americans account for only 4% of these senior executive positions and Latinas/Latinos only account for 4%. In short, there is still a lot of work to be done.

The good news is that we are finally seeing proof that diversity is not just a nice concept. The data proves that diversity is actually essential to top returns and we know that PE firms (and their Limited Partners) are driven by being top performers. As 2020 comes to a close, it is comforting that the future in Private Equity will continue to be influenced by the data of diversity and this asset class can transition to leading the way to a more diverse executive landscape.